Why The Lumber Chart Has Gone Parabolic

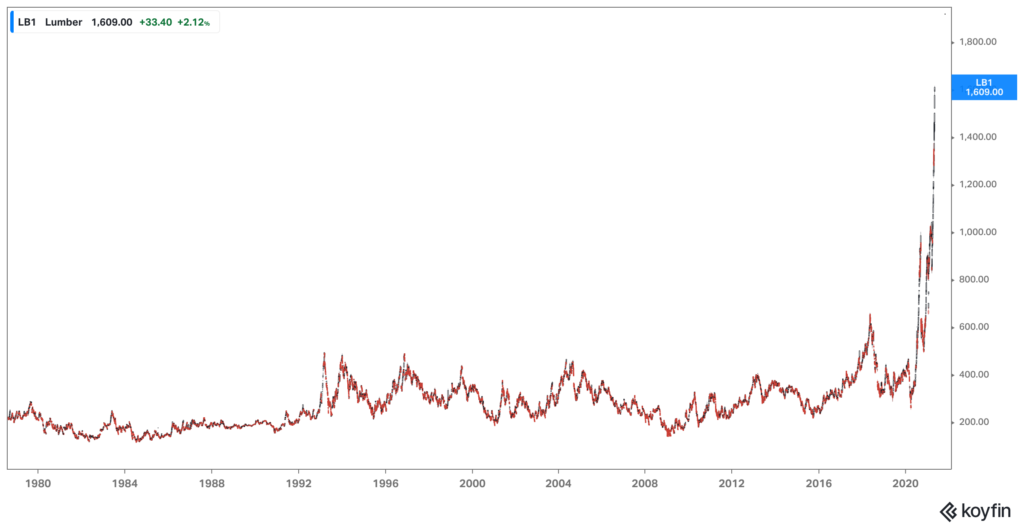

The lumber futures chart has been one of the most interesting economic price charts to watch over the past year. Lumber prices in the futures market are based on random length construction boards like 2x4s. Since 1978, the price has bounced between $200 and $400, with a brief all-time high of $600 in 2018. However, over the past year, the price has exploded to the upside rising from $300 to $1600 in just 12 months. It’s a rare economic moment that deserves a closer look.

This is a chart of the front-month lumber contract price going back to 1978.

Unprecedented demand during a shutdown

The onset of the pandemic created a massive increase in lumber demand. People stuck at home came to realize that their home wasn’t exactly what they wanted. Within a short window, consumers dramatically increased their buying, building and remodeling activities at massive scale. At the same time, our sawmills shut down during the worst months of COVID last year. With the increase in demand during a shutdown period, sawmill production is far behind schedule.

The supply side is reacting quickly. Billions of dollars have been recently invested into building new sawmills in the South where we grow a significant amount of our timber supply. Those sawmills are aiming at increasing total lumber capacity by approximately 25%. When you look at the chart above, you might wonder if we are running out of trees to support lumber production. Fortunately, that’s not the case at all. There is a tremendous supply of trees in the southeast of the US and the prices of timber have not moved at all.

We have plenty of timber

Timber has been advertised as a steady investment opportunity for decades. In the 1980s the US government had a program where they paid farmers to convert their land into tree growing. The thesis for investing in timber is simple: it requires significantly less maintenance than farming and the trees grow every year regardless of the performance of the stock market. This thesis became so popular that Harvard’s endowment at one point had a professional timber investment team. However, due to the popularity of the opportunity, oversupply has led to mediocre returns.

Sawmills control the price

Over the past 12 years, sawmill businesses have consolidated their pricing power by buying up and combining existing players. They’ve also added new sensors and automation to their systems, turning them into highly sophisticated operations. Despite the billions being invested into sawmill facilities in the south, it will take roughly 12 months to have those facilities running at full capacity. Sawmill employment has taken a hit due to government assistance programs and it may take some time to find enough labor to run the mills. Until the new sawmills are at full capacity, the price of lumber is likely to stay at the higher range.

A 75% drop from here is likely

Over time the price of the timber (logs) and the price lumber (boards) will converge. We have no shortage of trees, so it’s just a matter of how long it takes to convert our supply into lumber to meet the increased demand. If you have the flexibility to wait on buying the lumber, know that the price isn’t going to remain at this new level forever.

One new revenue source for timber farmers today is the carbon credit market. Net carbon producers, like manufacturers or oil companies, can purchase carbon credits as a way to offset the environmental impact of the business. Already, timber farmers have collected hundreds of millions in carbon credits to postpone cutting their trees down for another year. Perhaps the carbon credit market will start to eat into the available supply of trees, but that seems like a long way off.

It’s difficult to profit from this coming price drop. The futures contracts for lumber prices at future dates are all trending down (this is called backwardation). You can’t expect to profit from shorting the lumber prices when the future prices are already predicted to be substantially lower than they are today. While we wouldn’t recommend that you short the lumber futures market, you can at least gain confidence that the sticker shock of these astronomical lumber prices won’t last.

Weekly Articles by Osbon Capital Management:

"*" indicates required fields