Weekly Articles by Osbon Capital Management:

"*" indicates required fields

Direct Lending & AI

Direct lending and private credit Historically, banks dominated corporate lending, providing the majority of debt financing to both large and smaller businesses. However, the great financial crisis severely impacted banking lending capacity. This was due to tighter regulatory restrictions, capital constraints, and a shift towards more conservative balance sheet management. This void in lending capability paved the way for non-bank…

QQQ Rebalance & AI Model Collapse

QQQ – Nasdaq Rebalance The Nasdaq 100 index is in the middle of a special rebalance due to the overweight of the largest positions. Microsoft, Apple, NVidia, Google, Amazon and Tesla collectively make up over 50% of the index. In order to maintain balance, Nasdaq will redistribute the weights by selling those positions down slightly and increasing the other 94…

Uneven Recovery, GPT Example, Quick Bites

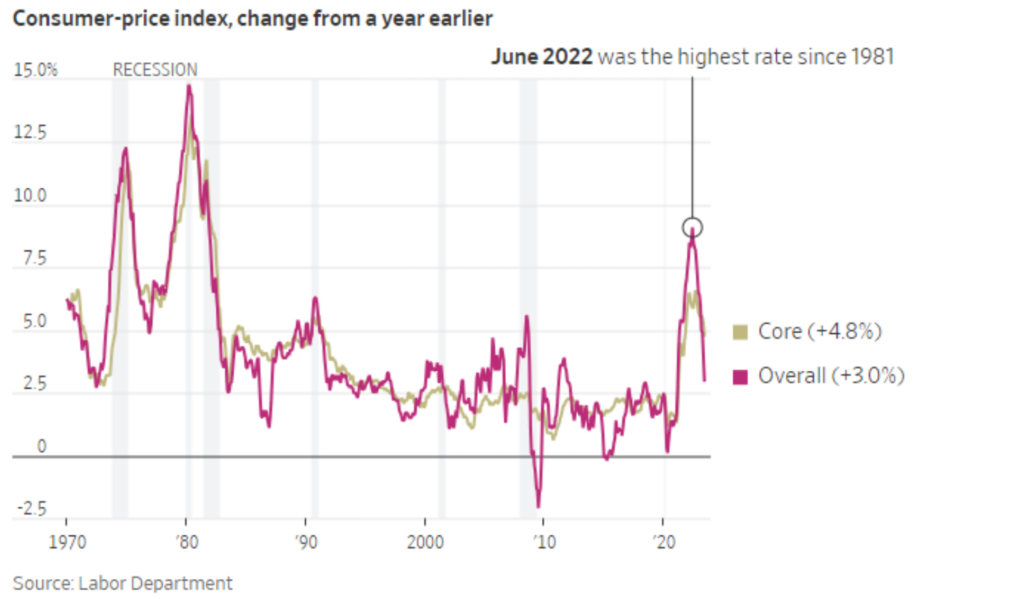

Uneven Recovery Yesterday’s latest inflation (CPI) number continues the downward trend, which is exactly what people want to see. The unattractive part of the report was the 7.8% shelter inflation, which is a core issue. More on that below. While the S&P and the Nasdaq are recovering just fine, many asset classes are still down badly. The long-duration Treasury market…

Literacy and Education, Bitcoin, AI

Demographics & Literacy We’ve written recently about the importance of demographics in investing over long periods. This week I wanted to highlight the role that education plays. As a refresher, population growth is a significant tailwind for a country’s GDP growth and vice versa. The United States has an immigration advantage that other developed nations have opted not to use….

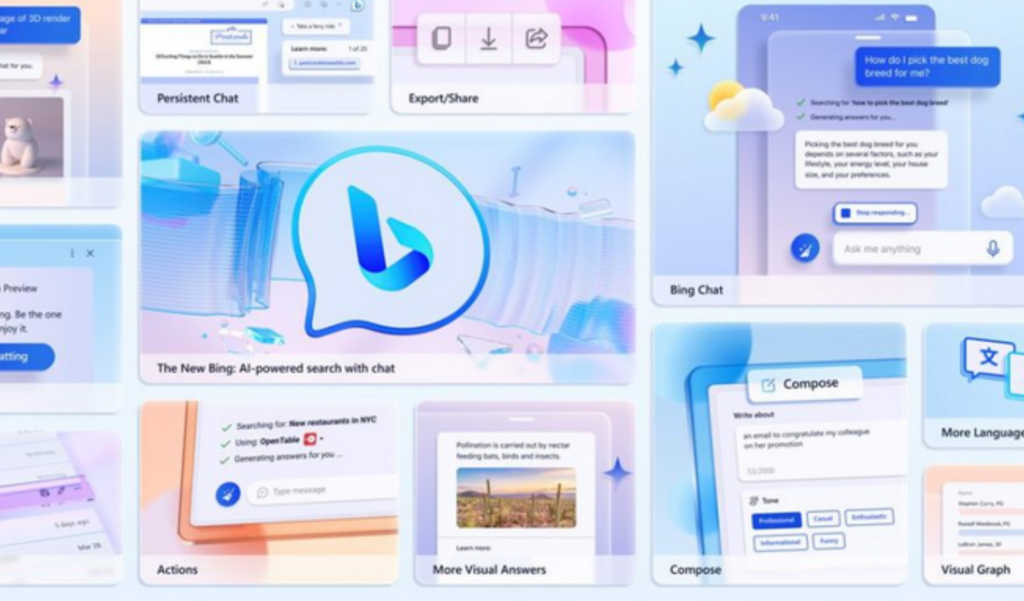

Early Days, NeuroHacking, Klarman, Fast

Early Days We are still in the earliest days of generative AI tools. Much of what has been released to date is a proof of concept. One neat emergent behavior of generative AI tools is that they seem to behave more like people and less like computers or calculators. Generative AI, so far, is lacking precision and accuracy, but it…

Progress, XB100 Deep Tech List

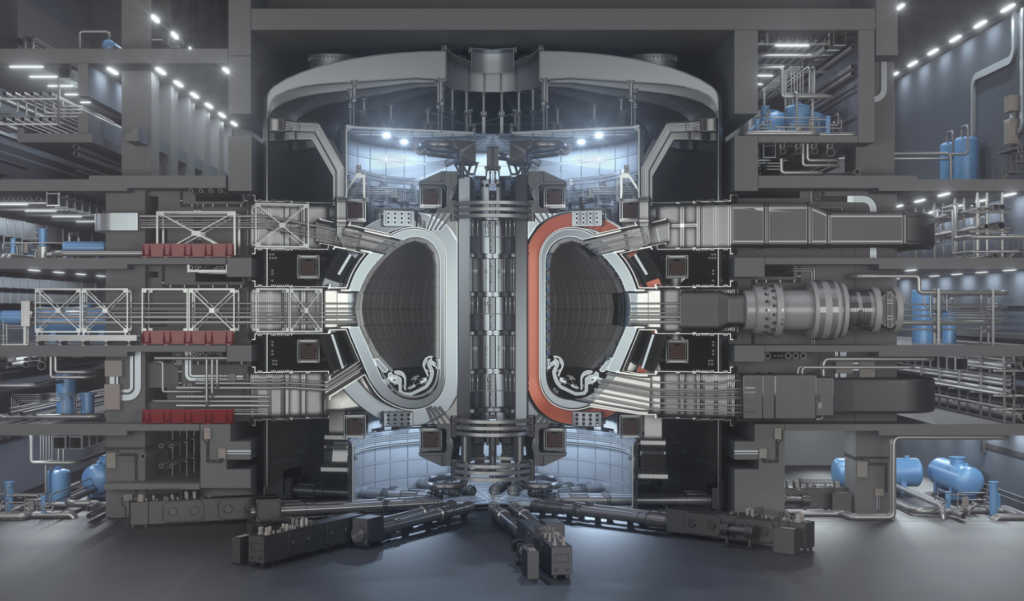

XB100 Deep Tech List – Bessemer I enjoyed reading this list of the 100 leading deep tech companies by Bessemer Venture Partners as well as the intro letter. Bessemer is also known for maintaining the Cloud 100, the leading 100 public cloud companies. While the list is probably repetitive for many, it’s useful to be aware of, for example, the…

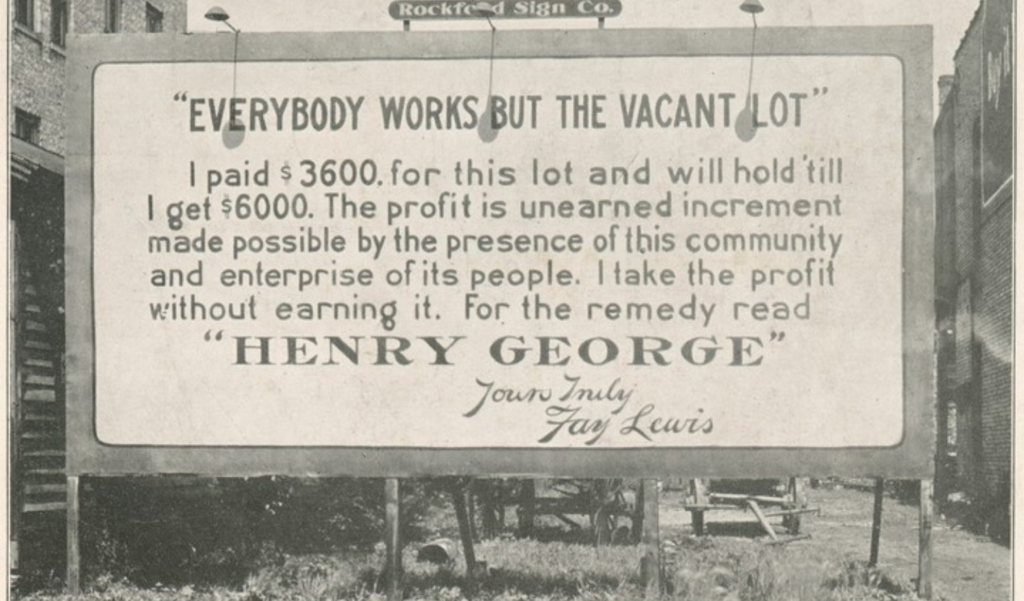

Henry George and Land Value Tax

Land Value Tax is a compelling and relatively unknown economic philosophy related to land taxation. Henry George popularized it in the late 1800s and fans of his work are known as Georgists. This week, we’ve decided to focus on this topic to spread awareness of Georgism as a plausible solution to our nation’s serious urban housing, inequality, budget and populist…

Winners and Waste, Federated Learning, Robotic Gardening

Mid-Year Winners The performance gap between the equal-weight S&P 500 and the regular-weight S&P 500 is on track for it’s largest gap since the metric started 30+ years ago. This indicates a growing split between haves and have-nots. The winners are obvious, they are the technology leaders with the largest balance sheets like NVidia, Meta, Google, Apple, and so on….

Inflation, NVidia, FedNow

Inflation Truflation’s US inflation metrics fell to 2.98% this week. This is a decent proxy for the direction of the CPI and PCE, the official government inflation statistics used to set policy. I’ve seen a lot of complaints in the media about prices still being high. An obvious but important note is that falling inflation does not translate to falling…