Five years ago I wrote, “Raise Your Expectations.” This week I am again urging investors to look at their after-tax investment returns. This is not the number your advisor or fund company may want you to focus on, but it’s really the only one that matters. Because it’s so important to your investment results, let’s revisit the after-tax topic and see why it’s still a problem the financial services industry tends to sweep under the rug.

Then and Now

In 2018 the vast majority of investors are still not getting the full story about their investment returns. What’s missing is one simple, understandable performance number: after-tax return. It’s time for investors to expect and hear a very simple statement: “Here’s your rate of return after taxes.” Every CPA I have talked to agrees on the substantial impact of taxes on returns. I expect much of the financial industry still cringes at the idea of after-tax reporting, but when it comes time to pay your mortgage or buy clothes, you can only spend what’s left after taxes.

Let’s say your portfolio starts the year at $1 million and finishes at $1.06 million (with no additional capital invested). What’s your rate of return? Of course it’s 6 percent. Unless you pay taxes on dividends (you do) and on capital gains (you do). If you end up paying $15,000 in taxes on dividends and gains, your 6 percent return quickly becomes 4.5. The 6 percent is a mirage; you keep and can spend only 4.5 percent.

By ignoring this simple math, most money managers and mutual fund companies give an incomplete and exaggerated view of performance. We believe after-tax return is an essential number, we manage for it, and we welcome the opportunity to discuss it with every client.

Twenty-five years distribution-free

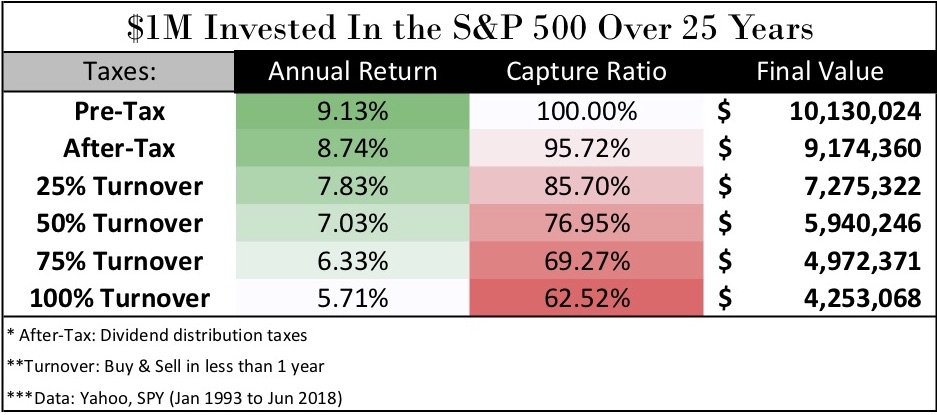

The first step we take to reduce the tax bite is using index ETFs. The largest, and oldest ETF, SPY (which tracks the S&P 500) turned 25 years old earlier this year. Investors who owned SPY for the last 25 years would have compounded their money at 9.13%, a rate anyone could love. That’s doubling your money every eight years.

But wait, what about taxes? The only taxes that buy-and-hold SPY investors had to pay each year were the state and federal taxes on dividends. With minimal turnover SPY has had NO capital gains distributions in 25 years, and therefore has triggered no capital gains taxes for investors. Factoring in taxes on dividends, the annual compound return is 8.74% percent. That results in a “capture ratio” – the percentage of return left after taxes – of 96% percent.

With this high capture rate, $1 million invested in 1993 would be worth $9.1 million today.

If the same portfolio had been managed in a way that generated lots of turnover (buy and sell transactions) and realized gains – which is typical for active managers – tax exposure would rise and the annual after-tax return would be far less. For instance, if half of the gains each year were distributed and taxable, the after-tax return would be only 7.03 percent. That’s a capture ratio of 77 percent, meaning 23 percent of the annual gain goes to the IRS. With this 50 percent tax exposure (the yellow line below), instead of growing to $10.1 million, the after-tax value is $7.3 million.

If all of the annual gain is taxable each year, the capture ratio falls to 62 percent and the ending balance reaches only $4.3 million. Talk about catch-and-release!

What’s your after-tax return?

Has your money manager ever helped you calculate it? To do so, just reduce your return by any state and federal taxes paid on dividends and short- and long-term gains. What you keep is really the only number that matters. It should be front and center when you discuss your goals and results with your investment advisor.

Weekly Articles by Osbon Capital Management:

"*" indicates required fields