Weekly Articles by Osbon Capital Management:

"*" indicates required fields

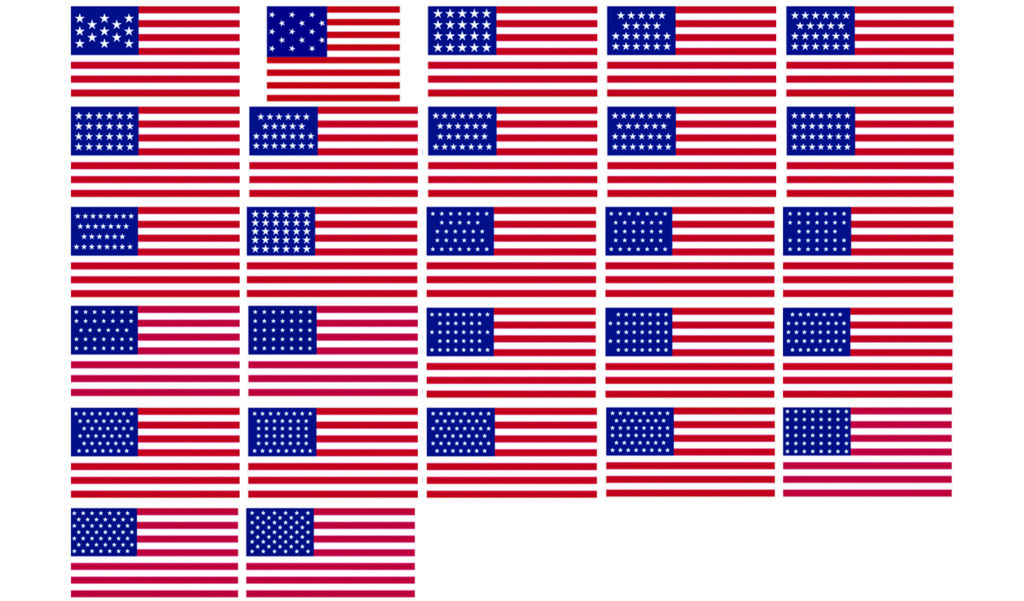

A Message of Unity

For this July 4th on Saturday we are sending out a picture of the various American Flags that have existed throughout the founding of our country. You can see how the stars and stripes have changed in number and design. These flags are a reminder that our country has changed a great deal in 244 years, and will continue to…

The Math of Retirement

There are many ways to look at your financial circumstances over the course of a lifetime, but at some point we all give some thought about how well prepared we are for retirement. Will money be tight, or will we have plenty to live the life we envision? Do we need to make changes in investments, spending or expectations? Let’s…

Consensus Is Rare

It’s difficult to get a broad idea across in one headline. When it is done in the investment media, the bias almost always skews negative, mostly for dramatic effect. If all indicators were bad, everyone would want to sell and there would be no buyers. With positive consensus, on the other hand, there would be no sellers. A broad and…

Free Is Not Free

Schwab made the headlines last week when the company announced it was cutting its trading commissions to $0. While this may seem like a great deal and an obvious win for consumers, there is more to the story and cause to be dubious. Specifically, if Schwab earns nothing via buying and selling securities for its clients, then how does it…

100-Year Bonds for the United States

The US Treasury has been considering issuing 100-year bonds for some time. Based on recent comments by the US Treasury Secretary this may actually happen this year. These are unusual monetary times that allow the government to lower its financing costs. But what are the implications for US individual investors? Do bonds due in 2120 make sense for you? Current…

The Almighty Dollar

Heading into the final third of the investment year there are few sure things for investors to count on. One sure thing, however, is the US dollar. It has been appreciating slightly for years, and has been strong even though the US economy would be doing better with a slightly weaker dollar. Why do we believe dollar strength will persist?…

Our Favorite Theories, Principles and Laws Named After Famous Thinkers

This week we decided to have some fun by exploring our favorite eponymous laws, theories and principles and how they fit into the world of investing. This is a list I’ve been wanting to write for a while, at least since I discovered Sayre’s law two years ago. The fantastic thing about these observed laws is that they are based…

Steps To Prepare The Next Generation For Wealth

Wealthy families often find themselves debating how to best approach the subject of family wealth with their children. The hesitation tends to center around how to share information about wealth while maintaining motivation and instilling the values of hard work and responsibility. What’s the right age? What’s the right level of detail? Where should you start? Here are steps you…

A History Lesson from Ray Dalio

Ray Dalio published his “Paradigm Shifts” on July 17. I recommend it for any investor who wants an intelligent, dispassionate history of investing broken down by decade. Ray Dalio and Bridgewater, the hedge fund he founded, have the money and the track record to back up his assertions. Is another paradigm shift happening now? What does Ray Dalio have to…