Week 7: Airbnb, Zombie Companies and Jamie Dimon

Briefing: Airbnb is an excellent example of a positive-sum business, one that has generated $150B in booking revenue for its hosts while unlocking previously unavailable real estate for travel. | Zombie Companies are companies that do not generate enough earnings to cover the cost of their debt, but that’s not the whole story as times have changed. | JPMorgan opened a small location in Decentraland and put a picture of Jamie Dimon as the first thing you see when you walk in.

Some people are now living full time in Airbnbs

Before we dive in, this is not an endorsement for investment in Airbnb. I chose to write about Airbnb this week because familiarity with the underlying companies driving trends and markets can provide helpful context when looking at markets as a whole.

Airbnb has facilitated $150 billion in payments to its hosts since it first launched in 2008. As a platform that serves guests and hosts, they have unlocked incredible value where it previously did not exist. It’s an excellent example of a positive-sum business (one that gives more than it takes) and a successful example of decentralization (anyone can now run a boutique vacation service). Today it’s one of the most important hospitality brands globally, with six million listings worldwide and growing. The marketplace network effects that come from its size help it lock in many competitive advantages. In Q4 2021, 20% of bookings were for one month plus, and 175,000 guests stayed for up to three months or longer. A not so insignificant number of people now live in Airbnbs full time.

Short vacation rentals previously required brokers, deposits, wires and multiple emails back and forth confirming details. Airbnb is one of the best examples of software automating once challenging and wasteful processes. As population growth slows to zero in developed nations, we increasingly need to rely on software, robotics and automation for productivity and GDP growth. There is so much room for automation to improve how we interact and share resources. Covid helped accelerate the adoption of new useful technologies, but people are still slow to adopt and implement new better alternatives for conducting business.

Notably, Airbnb has lost very little market value in this latest selloff. They increased their share count dramatically to sustain the business in the face of Covid, meaning investors were diluted, but it had little impact on investor returns. I won’t comment here on whether I think it’s a good investment at this particular price. I do think it’s one of the best examples of emergent technology successfully reinventing and dramatically improving an ancient industry.

Zombie Companies

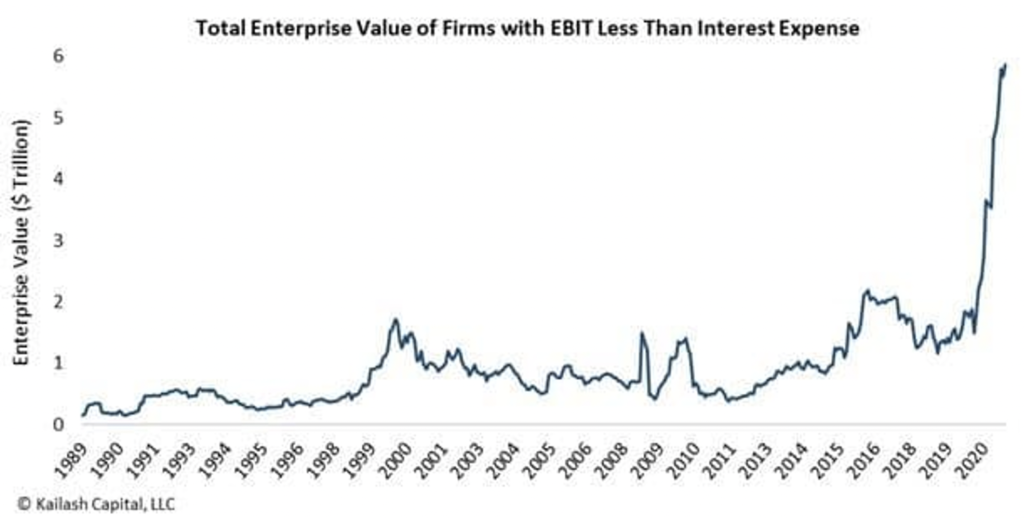

The search term “Zombie Companies” peaked in June 2020. You may remember hearing the term referring to companies that don’t have enough earnings to cover the interest payments on their debts. The Mises Institute, known for traditional economic thought leadership, published an interesting piece on the subject this past week. Take a look at the chart below from their article that shows a sharp increase in the total enterprise value of “zombie companies.”

It may appear that we are in dangerous uncharted territory. That’s always possible, but it’s missing crucial context. Silicon Valley pioneered a different set of risk-taking frameworks that turned out to be correct and highly profitable. One framework includes staying unprofitable for longer in order to capture more of a given market. Growth before earnings is the mantra and it works well in a winner takes all market.

For example, over the past 12 months, Airbnb has not generated enough earnings to cover its interest payments. Airbnb’s previous 12 months were not profitable but it is anything but a “zombie company.” Amazon drove Wall Street analysts crazy with this strategy as they continuously reinvested operating profits into new businesses which gave the appearance of unprofitability. Why pay taxes on profits when you can reinvest into R&D or sales and marketing to grow the business? This strategy led Amazon to grow into one of the best vertically integrated and most innovative businesses.

Zombie Company narratives like this persist because they grab people’s attention as a warning sign. I don’t know exactly how many growth businesses are mixed into this “zombie” narrative but I do know from the above example that it’s not zero. I’m certain there will be more coverage of zombie companies going forward and it’s important to know the full story in advance of that narrative hitting CNBC.

JPMorgan opened the first banking location in the crypto metaverse Decentraland

JPMorgan’s crypto division Onyx recently opened a location in Decentraland on plot coordinates 94, 21. There are now 4,400 unique “landowners” in Decentraland, up from 1,700 at the start of 2022 for 150% growth in 45 days.

JPM’s small location has a tiger roaming the lobby, a handful of videos on the walls, and a photo of Jamie Dimon at the entrance. The Onyx team is trolling their CEO who routinely publicly shuns crypto assets. Like Visa buying a Cryptopunk NFT, this is simply a fun way for JPM to spend marketing dollars for press and brand marketing. There is nothing to do at the location but people remember when you’re first to a new market.

As for Decentraland itself. It’s hard to imagine a more poorly designed metaverse experience. The platform remains semi-dominant due to its first-mover advantage. The market cap of the entire project sits around $7 billion and its native coin $MANA trades more than $1B in volume per day, which for context is just slightly lower than the JPM stock’s daily volume. If Decentraland is going to be long-term successful, they will need to fully redesign the user experience from top to bottom, which makes me think they are a prime target for displacement and disruption.

Weekly Articles by Osbon Capital Management:

"*" indicates required fields