Briefing:

- The risk curve is shifting further out for investors. Bonds have become extremely unattractive, especially when compared to the historically risky asset classes.

- AI models are learning more complicated tricks.

- There’s a new robot training to paint our streets.

- The NBA is opening ownership to PE firms with significant limitations, highlighting the importance of the owner’s mindset.

Shifting Risk Curves

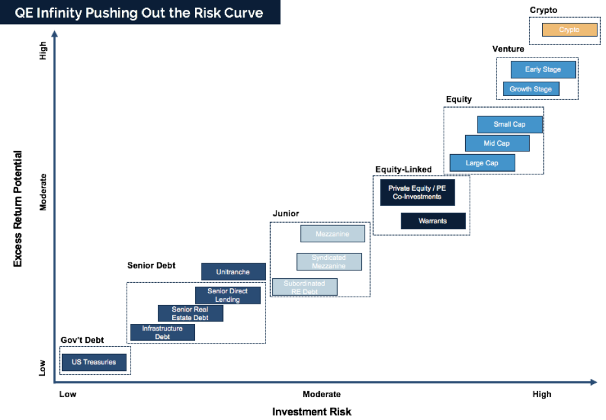

Defining risk can be a challenging philosophical task. Today, most people would argue that the entire risk curve has shifted farther towards historically “risky” assets. Bonds have become cash, quality equity has become what bonds used to be, venture capital has become equity and crypto became the new venture capital.

Part of the problem is that bonds are extremely expensive today. The “Agg” bond index, which is like the S&P500 for high-quality bonds, yields just 1.3%. There’s minimal potential to earn more than 1.3% per year going forward through these bonds. If you own high yield junk bonds, it doesn’t get much better. Low-quality bonds pay just 3%-4% per year. Apple stock, by comparison, has a total shareholder yield including buybacks of 3.8%.

Venture capital, specifically late-stage venture capital, has taken away from the equity market. Well-capitalized VCs are providing massive amounts of capital to private unicorn businesses to help them stay private longer. Stripe (the payments company) is a prime example. Once Stripe IPOs, it will likely be worth $100B+. In the meantime, crypto has generated $1.8 trillion in new market value over the past 12 months.

The rapid emergence of crypto goes far beyond any claim of scams or cult-like behavior. The crypto community is attempting to replace banks entirely by reinventing how money functions in the internet age. That’s a very “venture capital” type of challenge and opportunity.

If the share of the gains over the next five years belongs more to crypto, venture capital and equity, then one could say that it’s risky not to participate in those markets. Fortunately for all investors, the lines that separate these asset classes are increasingly blurred. Most of the power of these asset classes is available in public markets. Today’s investors likely have to change how they evaluate risks, especially compared to historically popular narratives. When you clearly understand current and future liabilities, you know when it’s OK to reach out further on the risk curve. We call this Liabilities Driven Investing, and it’s a very practical framework for managing risk.

Artificial Intelligence – How do you teach a robot?

IEEE Spectrum had a great article last week on how AI models “learn.” Reinforcement Learning is the main method used today. It involves rewarding “behaviors” that bring the agents closer to a certain goal. This is simple when there is one agent who needs to achieve one goal. This becomes especially difficult when the reward requires a complex and coordinated strategy over a longer series of steps. A good example of a complex coordinated task is a simulation of a human body walking.

In order to “learn” to walk, a simulated body must correctly use its feet, ankles, knees, hips, weight distribution, all in the right order optimal for walking. You can see how this would get very complicated very quickly. Luckily robots don’t get frustrated.

Reinforcement Learning works well because it allows an AI program to adapt to a constantly changing world by figuring it out as it goes. We don’t have all of the data or models to provide the answers to AI models as to what works and what doesn’t – that style of training is called supervised learning. Intel was able to use a concept similar to genetic evolution where the better models went on to improve, and the worse models were discarded. There is an explainer video from Intel here. What does this all mean? Artificial intelligence is making real progress and evolving rapidly.

Clever Robots – Leveraging New Technologies To Start New Unique Businesses

Cleveland-based startup RoadPrintz attached a sophisticated robotic arm to the back of a pickup truck and is using it to paint detailed road markings. This robotic arm will reduce repetitive and dangerous road work, reduce costs, increase accuracy and increase the number of completed projects. The robotic road worker was constructed using commercially available equipment and open-source software. As technologies advance, they open new doors for entrepreneurs to experiment. The future is always bright for clever people!

Lessons from the NBA – Ownership and Leadership Matters

The NBA just started allowing private equity firms to participate in NBA team ownership, but there are significant limitations. Per the rules, no team can be more than 30% owned by PE firms and PE firms can’t own stakes in more than 5 teams at once.

Private equity firms are focused on maximizing profitability and growth, often for the short term and for funds that have life cycles. They are not the kind of owners that would be incentivized to make a team “special.” It’s clear that the NBA put these PE rules in place to preserve strong leadership values among its owners. Investors should prioritize good company leadership within their investments as well.

Harvard Business Review has a great article on this topic: why founder-led companies outperform. Why does leadership matter? Great leaders have the passion to be great, are obsessed with front-line details and have skin in the game. Without these traits, organizations become complacent, slow to act and decide, and risk-averse. Today’s founder-led companies like Twilio, Shopify, Cloudflare, Atlassian, Facebook, and many others like them have clear advantages often due to the quality, intense focus and longevity of their founding team.

Weekly Articles by Osbon Capital Management:

"*" indicates required fields