Briefing:

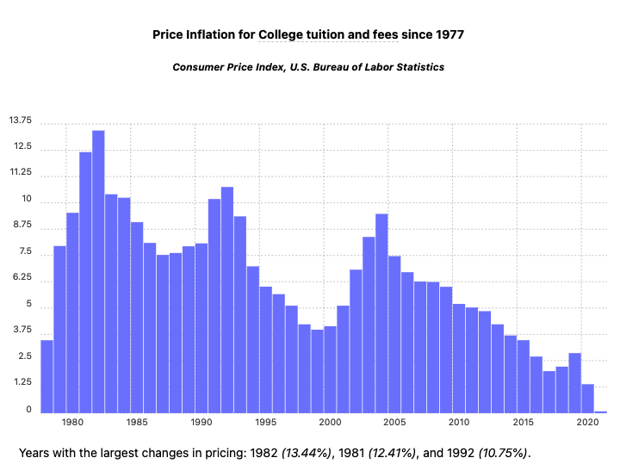

- Despite constant headlines of inflation, college tuition costs have barely increased. University tuition inflation is at 40-year lows and trending downward.

- Ray Dalio’s Pure Alpha fund returned just 1.8% annually for the last 7 years. He’s largely missed the growth of emergent internet and technology trends.

- El Salvador is taking a bold step forward with Bitcoin by making it a national currency. This increases adoption rates and adds new legitimacy.

College Tuition Inflation Is In A Downward Trend

Here is some good news for parents and students. College tuition costs have been rising at the slowest pace in more than 40 years. Tuition inflation is near or below 1% today. Dozens of universities have closed or merged over the past few years as the industry goes through its next phase of evolution. Technology and software is a big driver of deflation as it enables greater efficiency and access. You can expect these trends to continue, and you may even see the cost of education begin to decrease in the coming years.

Ray Dalio & Keeping Up With Change

Many famous billionaire investors like Ray Dalio, Howard Marks, Jeremy Grantham, and Jeffrey Gundlach have been vocal that major issues in today’s public markets are often more negative than positive. These four investors have repeatedly stated that we should reduce our return expectations from now on. However, these same investors have missed much of the tech rally of the last decade and almost all of the crypto rally of the past few years.

Ray Dalio’s firm Bridgewater is one of the largest hedge funds in the world at over $100B in AUM. Bridgewater made headlines last week that its core strategy named “Pure Alpha” has returned just 1.8% annually for the past 7 years.

Ray Dalio has been a vocal life coach and pontificator. My favorite of his works is the Big Debt Book which is available for free here. The one major takeaway of the debt book is to never owe money to another country in their currency. The most famous example is Germany post-WWI. Fortunately for us, despite our large debt balances, our US debt is denominated in USD.

Despite Ray Dalio’s phenomenal research pieces, he has repeatedly missed the most important macro trend: the impact of technology on our global economy and the winner take all nature of internet-based businesses. Howard Marks addressed these technology-related shifts in his recent 2021 letter titled “Something of Value.” Howard called the shift, “not your grandfather’s market.” He pointed out that, “Because markets are global in nature, and the Internet and software have vastly increased their ultimate profit potential, technology firms or technology-aided businesses can grow to be much more valuable than we previously could have imagined.”

We agree with Howard Mark’s. Keeping up with the pace of change is crucial to future success. We work to align portfolios with positive tailwinds driven by technology, including the insatiable demand for computing power (semiconductors), the emergence of AI, digital banking and digital health transformations, cloud computing, and so on. As great as Ray Dalio’s research pieces are, we believe that the digital transformation and the impact of the internet is one of the most important macro factors impacting markets today. When you view the world through this lens, it’s much easier to be optimistic.

El Salvador’s Bitcoin News

This will be good for El Salvador in the long run because a willingness to experiment is crucial to growth and progress. Even if the BTC experiment goes nowhere, this experience will put them ahead of their counterparts. Under this new legislation, every citizen gets $30 of BTC when they open their Chivo account, and the government recognizes BTC as an official payment method. El Salvador has a population of 6 million. Of that, nearly 5 million are cash-only and have no social security number. This is a big jump forward for the country. A big BTC currency question remains: Why would you spend $30 of BTC today when it may be worth $100 in the next year or two?

The El Salvador move is in line with our main crypto thesis: increasing adoption. As adoption increases, crypto will continue to grow. Crypto is software, which means it can rapidly evolve and change. It’s getting harder not to write about crypto each week as some of the most interesting innovations emerge on a near-daily basis. The returns are staggering as well. Race Capital, for example, invested $3.2 million into Solana in 2018. Solana is focused on enabling faster blockchain TPS (Transactions Per Second). That investment is worth $14.4 billion today as Solana has become one of the hottest cryptos of the past few months.

Damien Hirst NFT

Over the Summer, the contemporary UK artist Damien Hirst released a crypto-related digital project titled “The Currency.” The project sold 10,000 copies of his signature dot-themed art and require the collectors to “choose their currency” and receive a digital NFT version or a physical print version. Collectors are not allowed to keep both. If they chose to keep the NFT version, then the original copy is destroyed and vice versa. I’ve since been quizzing people on their answers and have been surprised to find that the majority of people I talk to opt for the digital version specifically to “have less stuff,” regardless of age or tech-savviness. Maybe this says something about changing consumption habits to come.

Weekly Articles by Osbon Capital Management:

"*" indicates required fields