Happy New Year and Welcome to Week 1 of 2022!

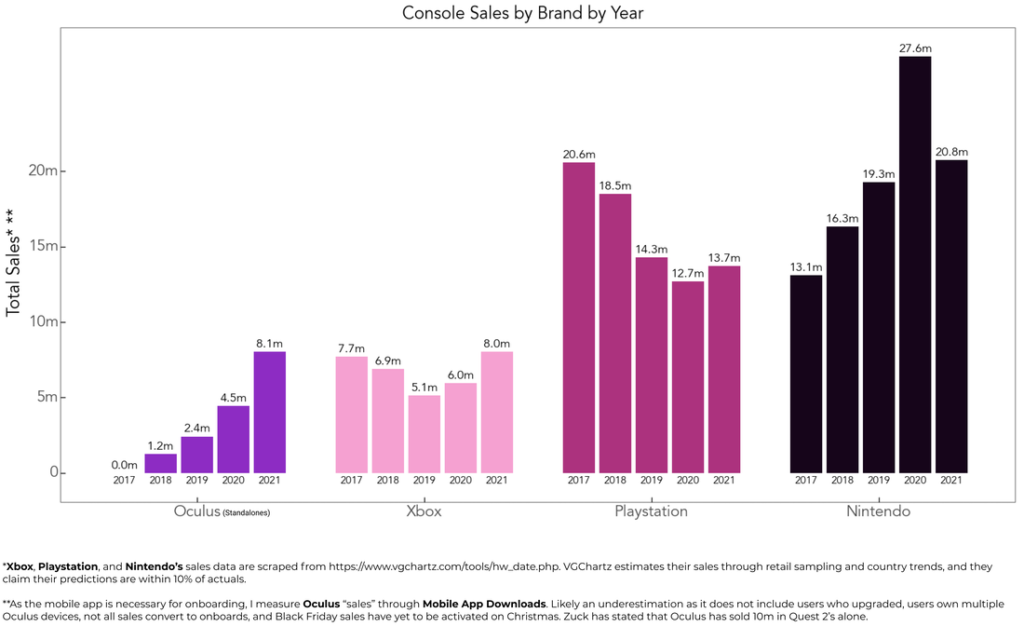

Briefing: Byron Wien released his annual markets surprise list highlighting global energy challenges as a recurring theme. | We have seen the first proofs of concept of a diverse set of robotic workers ready for everything from grills to warehouses. | The Oculus headset outsold the Xbox for the first time marking a major milestone in VR and metaverse adoption. | Adidas raised $23 million in NFT sales last month making it the first large legacy corporate beneficiary of the NFT trend.

Byron Wien’s Annual Surprise List: The most famous annual prediction list in the traditional finance world is Byron Wien’s “Ten Surprises” — now in its 37th year. It’s named a “surprise” list because each event is intended to have a one in three chance of occurring in the next year. The quick highlights are:

- 10-year treasury hits 2.75%, up from 1.7% today.

- Gold rallies 20% to a new all-time high as the ultra-wealthy seek safe havens during an inflationary period.

- Oil rises above $100 per barrel, from $80 today, as production cannot keep up with demand. This has the added knock-on benefit of increasing demand for alternative clean energy. Nuclear energy finally gets a positive breakthrough in the US, and there are not enough lithium batteries to match the demand.

- Puerto Rico becomes the retirement destination of choice due to extreme tax benefits. This trend is already underway.

- Jamie Dimon reverses his stance on cryptocurrencies, and JPM seeks to become a leader in the space. They are very far behind!

The complete list can be found here.

Something to think about here: at best, annual predictions align with the weather, tax calendar, financial reporting standards and portfolio rebalancing activities. While those events do have short-term impacts, just about everything else in the world follows its own trend on its own timeline. We can still try to box the predictions into 365-day windows for fun. However, the more valuable exercise is to follow the progression of the trend on its own timeline. The post-COVID energy trend is certainly one of the most interesting stories of 2021/2022. What is our vision for navigating from fossil fuels to clean energy while working within real physical and economic constraints? It won’t be easy.

The Great Robotics Rollout

Boston Dynamics has created a warehouse robot called ‘Stretch’ to help load and unload trucks at the warehouse, which is typically the most challenging of the warehouse jobs. Stretch works at the same speed as humans (800 boxes per hour at approx 50lbs each) and runs 16 hours per charge. Instead of two people per truck, the goal is to have one person monitor multiple stretch robots working on multiple trucks. Therefore, the taxing physical work becomes robot supervision, and one supervisor with a team of robots could replace up to eight workers. Stretch deliveries begin in 2022.

Over the past two years, we’ve started to see robotic proof of concepts pop up in indoor farms, construction sites, coffee shops, building security, burger-flipping stations, warehouses, truck driver seats, retail spaces, labs, and so on. As wages increase, we can expect more pressure to roll out teams of robot workers. The robotic supervisor role is a far more efficient use of human capital. There is a significant risk of job loss due to AI and robotics over the coming years, and we will have to be proactive with creating new jobs and training programs for those who are displaced. 2022 may end up being the first year of the great robotics rollout. The incentives are certainly there to make it happen and the tech is not far behind.

Oculus outsold Xbox in 2021

In 2021, the immersive metaverse headset Oculus outsold the Xbox for the first time with 8.1m units vs. 8.0m units. The Oculus and future VR/AR products from other major tech players (like Apple) will undoubtedly open the metaverse for mass participation. There is an entire metaverse industry waiting to be built by virtual creators. VR technology needs noticeable improvement, but adoption seems to be increasing rapidly regardless.

Adidas raised $23 million via NFT sales

It might seem silly or strange, but the data doesn’t lie. NFTs are officially a corporate success story. Last month Adidas raised $23 million selling 30,000 NFTs for .2 ETH each. These NFTs can be used to gain priority access to future physical and digital products. This access can be particularly valuable for people who wait in line for product drops. These Adidas NFTs have increased 4x since release and are available on the OpenSea marketplace.

OpenSea is the largest and most trusted NFT platform in the crypto/web3.0 world, and this week they closed their most recent raise of $300m at a $13.3B valuation. Trusted brand names are extremely valuable in the crypto space where scammers are always looking for unsophisticated or unaware internet users, of which there are many. One safe prediction for 2022: we’ll see another legacy corporation beat that $23 million Adidas NFT record.

Weekly Articles by Osbon Capital Management:

"*" indicates required fields