If you are suffering from too much news (“infobesity”) and too many dire predictions (“calamity fatigue”) then the annual Windham Global Solutions client conference last week would have been a welcome break.

If you are suffering from too much news (“infobesity”) and too many dire predictions (“calamity fatigue”) then the annual Windham Global Solutions client conference last week would have been a welcome break.  It was for us. Windham, our asset allocation and risk management advisor, had a full menu of meaty topics over two days. Here are some highlights.

It was for us. Windham, our asset allocation and risk management advisor, had a full menu of meaty topics over two days. Here are some highlights.

Windham is a key service provider for us. Its software, which allows us to customize diversified global equity, bond and alternative investment portfolios for each client, is an essential and unique resource. With Windham’s client base composed primarily of big institutional investors, we feel very fortunate to have access to its tools. The annual conference always reminds us how smart and innovative the Windham team is.

Among many other activities, Windham tracks more than 300 indexes in its database, dating back to inception, from the S&P 500 to the emerging markets bond index. This wealth of data provides the perfect vantage point from which to view the history of investing and allows us to construct and personalize each portfolio according to goals, risk, and most importantly, likelihood of outcome. Windham is unique.

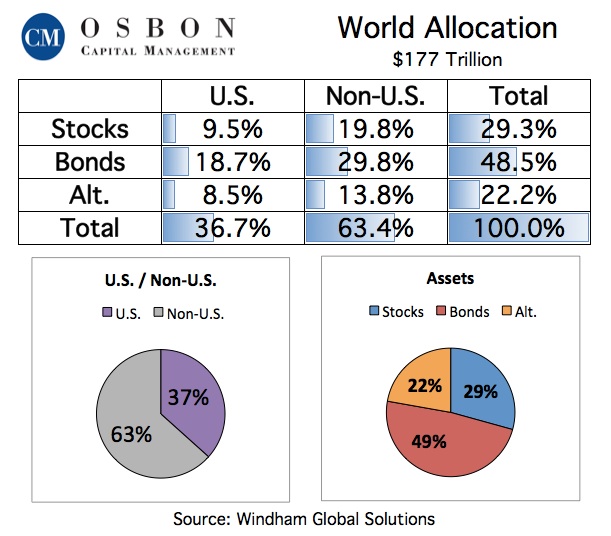

How big is the world?

At $177 trillion, the investment world is full of surprises, especially for many American investors who tend to use the S&P 500 as a proxy for “the market.” As Windham points out, stocks comprise less than a third of all investments, and US stocks amount to less than a third of all stocks.

The charts below remind us that diversification is not just about owning a wide variety of US stocks; it’s about owning equities, fixed income and alternative asset classes here and abroad. Windham’s software models guide us in doing so.

The Keynote

The Keynote

Mark Kritzman, Windham founder and CEO, gave the keynote address. Mark described the continuing evolution of portfolio management – away from a traditional “investment policy” approach where managers set investment percentages based on the old standard 20th Century 60/40 model to a much more flexible “ideal model.” The ideal model – what we often refer to as goal-based investing – starts with the end in mind, maximizes the likelihood of achieving goals, and incorporates individual needs, obligations, priorities, opportunities, desires and aspirations.

The ideal model aims for success on an individual client basis, the only metric that matters, we’re sure you’ll agree.

Other topics

There was much to learn and practice over two days. Other topics presented were Robin Greenwood’s (Harvard professor) Expectations question. Do expectations predict? Not reliably or consistently, he found. We also attended workshops on factor analysis (what is really influencing your portfolio) and cash flow and wealth analysis (money in, money out, money left over).

All in all, it was a fascinating opportunity to stay at the cutting edge of evidence-based (as opposed to prediction-based) investing.

Weekly Articles by Osbon Capital Management:

"*" indicates required fields