How far for how long?

It’s been a great year for US stocks, with indexes broadly up 25 percent or more. As the Dow hovers around 16,000, some pundits proclaim “it can’t go up any farther” or “sell everything now!” Are they right? Let’s take a fact-based look.

The long, high road

We all know that US stocks have gone up for the last century, compounding at about 9 percent annually, with a lot of ups and downs along the way. It’s human nature to question during a strong rally if stocks can go up even more. After all this up, aren’t we due to go down?

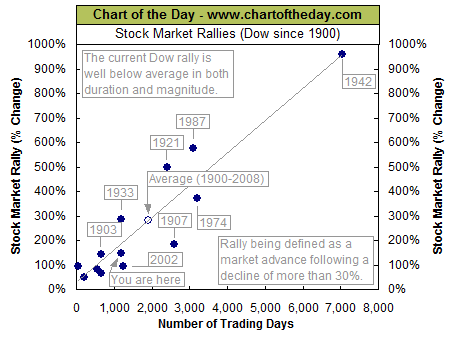

13 bull markets

Chart of the day shows the 13 bull markets of the last 113 years. Compared to the previous 12, this current advance is relatively young and small. But that doesn’t tell us much. There is no natural law that dictates that an up market must turn down or vice versa. We may see a correction that starts tomorrow, or it may be years. Many have opinions, but no one knows.

Don’t worry, plan

For anyone on the sidelines holding cash, it can be intimidating to buy in at or near record highs. But instead of guessing about whether there is a dip coming, we recommend focusing on the things you can control, like risk, taxes, and costs. If you are especially concerned about potentially buying in at the top, check our “market timeless” post. It offers an approach that may help.

Want to know more?

Give us a call at 617-217-2772 – we’d love to hear what’s on your mind

Weekly Articles by Osbon Capital Management:

"*" indicates required fields