2020 has reminded us that change is a constant in life. Change often brings an unpleasant jolt to our nerves. The good news is that we are all adaptable and creative by nature. The more you lean into the future, the easier it is to see the ways that innovation flows around challenges and always seems to find a way to bring us forward, onward and upward. In investing, this applies to the continuous potential for innovation and technology, which is in a golden era at the moment. Pessimists might only see the obstacles, and they’re not wrong to point them out. In the end the future belongs to the optimists. Here are some ways to wrap your head around the current challenges while taking advantage of investments that lean into the future:

Pessimism is common but resistance is futile

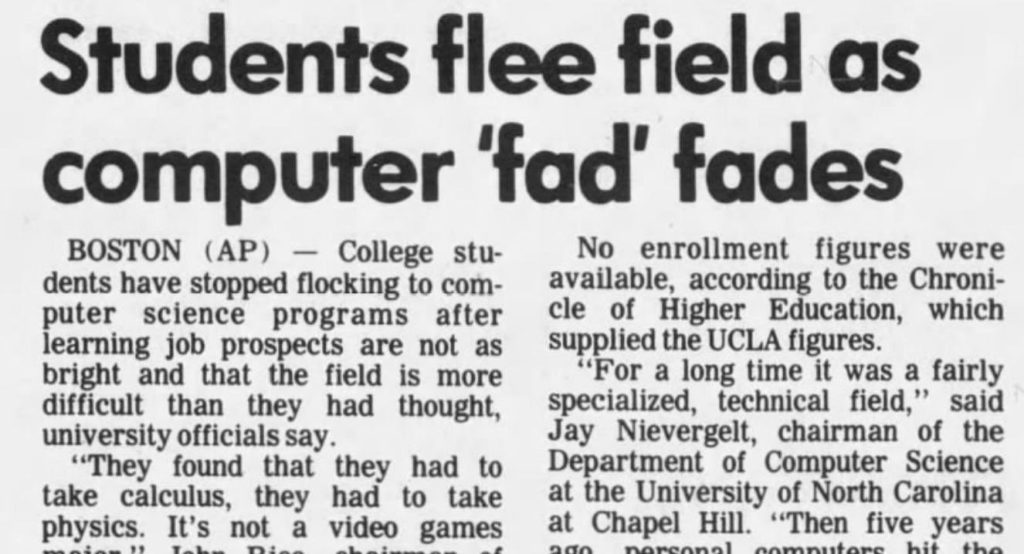

Jason Fiefer runs a great podcast called the Pessimist Archive where he seeks to answer the question, “Why do people keep resisting new things?” Jason is a thoughtful archivist of our society’s strange and persistent resistance to the future. After speaking with Jason this week, he pointed me to an academic study on the topic with a great title, “The Sisyphean Cycle of Technology Panics”. Given this title, there is clearly nothing new under the sun when it comes to fearful perspectives. You can thumb through the Pessimist Archive on twitter here. Here is one of the best of his archive (1987):

Excessive screen time, ineffective remote work, and too much social media are examples of recent fears Jason says we are starting to overcome. Managers and educators have historically resisted remote tools, despite their general availability over the past six or seven years. The work from home experiment will surely save us money and make us more efficient. There are hopefully some environmental benefits in there as well.

Jason says the pessimism around 5G and the impact of DeepFakes are two technological panics du jour that are likely next in line to be debunked. In the near term he anticipates major advancements in remote collaboration and remote education. Anyone with kids at home can attest that the current state of remote education is all around painful. Education tech presents a big opportunity for anyone from Google Classroom, to Khan Academy to any number of willing and eager startups.

Pessimists might ask, “What’s the point of investing in space travel?” Is there any real economic incentive or return in that sector? Chamath Palihapitiya says yes, there is, because through the process of solving complex space travel challenges, we will reap major advancements in material sciences and innovation as a whole. Remember that the very useful invention of the steam engine was a result of the need to pump water out of flooded coal mines. A classic 18th century pivot.

Advancements in AI, driverless cars, quantum computing, transportation, GPUs, software and biotech are available to investors who are open and willing to participate. Market pessimists often say, “private markets have taken over public markets” or “venture capital is not available to the average investor”, or even “ETFs are ruining investing.” There is always a piece of truth in these pessimistic statements, otherwise they wouldn’t resonate. The truth has been that public markets participate in plenty of innovation and produce amazing returns for investors when those innovations come to market. We believe this will continue in the face of all sorts of challenges, virus and politics included.

Finally, on innovation… Jeff Bezos definitively states, “you have to always be leaning into the future. If you’re leaning away from the future, the future is going to win every time. Never ever ever lean away from the future.”

Keep an eye on revenue growth

One key component of a company’s future equity growth prospects will always be its ability to grow revenue. Restructuring, buybacks, tax optimization, cutting costs and issuing debt are great optimizers for the bottom line of any company. Eventually, a business must grow their revenue in order to justify future equity growth.

In today’s environment, all companies must consider cannibalizing their current lines of business in order to keep up with the persistent wave of new competitive startups. The auto industry’s dragging resistance to electric vehicles and battery innovation continues to singularly benefit Tesla. Public real estate trusts, energy pipelines, manufacturers, oil and gas, and banking industries are having a tough time this year proving to investors that they can continue to scale their businesses while attracting even more revenue and growth for years or even decades to come. Technology, and software in particular, has the upper hand with revenue growth as they have proven since Marc Andreeson predicted the trend in 2011.

Deflation through technology

Despite the US printing trillions of dollars this year to combat the financial crisis brought on by Covid, we are unlikely to see inflation arrive anytime soon. Education, health care and housing are the only sectors that saw meaningful inflation over the past 20 years. Demonetization (making things free) is the 4th step in the 6 D’s of Disruption by Peter Diamandis, founder of the X Prize. Technology makes everything cheaper.

Many of today’s well known brands are firmly rooted in the past and will likely be outpaced by the next wave of emerging leaders. In the past 5 years, PayPal’s market cap has quadrupled while Goldman Sachs has fallen by -25%. Tech firms continue to innovate and produce more while saving the end user money in the process. We wrote about these trends a few weeks ago in, The Growth Era Is Here.

Universal basic income is likely and will be beneficial to all

It’s easy to be pessimistic about the state of the average American consumer. You may have grown up like me believing that welfare and financial support from the government disincentivizes workers. Prior to Covid, I largely agreed that our capitalist system requires financial incentives and motivation. Given where we are today, financial motivation alone is not cutting it for the majority of our population.

Gig economics are painfully weak for the gig workers. $5 for an Uber Eats driver for 20 minutes of work results in a net loss for that worker. In 1938, when minimum wage was established, it was meant to provide a living wage for a family. FDR said, “By living wages, I mean more than a bare subsistence level. I mean the wages of a decent living.” The capitalist game is now completely “out of reach” for all minimum wage workers in the US. There are only a handful of zip codes left in the US where minimum wage supports basic family housing needs.

Given our latest policy (and ability) to print trillions of dollars precisely when it’s needed, universal basic income seems like the logical and welcome next step. Mark Cuban suggested the US issue “use it or lose it” debit cards that expire and must be spent. Our stock market and economic system is reliant on the strength of the consumer. If we don’t intervene, then eventually the capitalist math will stop working for everyone. Inequality is a persistent yet entirely solvable challenge.

Investing in the future

Markets strategists continue to give reasons why investing is reaching the end of the road. Unlimited QE, debt levels, limited opportunity for growth, peak oil and peak population are a few valid criticisms. Investments in the future can be allocated through both public markets (single stocks, ETFs and Mutual Funds) and private markets (venture capital and angel investing). Real economic growth comes from owning a piece of the future. We have restrictions regarding the sharing of specific names of investments, public and private. Please contact us if you would like to know more about how we are incorporating ‘investments in the future’ into family wealth strategies.

Weekly Articles by Osbon Capital Management:

"*" indicates required fields