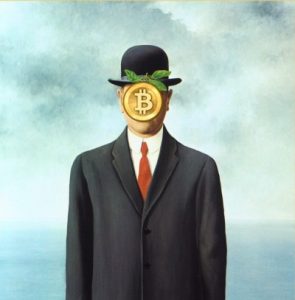

Bitcoin: a currency wrapped in a riddle

We don’t expect interest in Bitcoin to wane anytime soon. With a future price that could go to $20,000 or $0, it’s the ultimate speculative vehicle. It might even be the perfect holiday gift for the person who has everything and might be happy with a little bit of nothing.

We don’t expect interest in Bitcoin to wane anytime soon. With a future price that could go to $20,000 or $0, it’s the ultimate speculative vehicle. It might even be the perfect holiday gift for the person who has everything and might be happy with a little bit of nothing.

Any discussion of Bitcoin, an extremely innovative digital currency, can sound like science fiction. And maybe it is. But with its value up 7500 percent this year, it’s definitely getting attention. We won’t even dream of explaining all there is to know about Bitcoin, but here are a few tasty tidbits.

- Bitcoin is a medium of exchange that allows the movement of value from one online wallet to another much faster than the traditional bank wire method.

- A small number of retailers and other business accept Bitcoins – albeit mostly for marketing purposes, ie Richard Branson’s space flights.

- There is no Bitcoin company; it was devised by an anonymous person or group. So you can’t buy stock in the issuer, and there is no customer service to support BitCoin errors.

- It gets stranger. New coins are “mined” by networks of computers solving increasingly difficult cryptographic puzzles. The Economist points out that the constantly increasing computing resources needed to do this could ultimately cause its demise.

- The number of coins that can be mined is capped at 21,000,000. As far as we know. If that cap gets hacked, the value will almost certainly go to zero.

- Because thousands of computers are involved in the processing of any single Bitcoin transaction, the currency is thought to be protected from forgery, theft and hacking. Believers hope so.

- Nothing for something, sort of. There are 41 other ‘crypto-currencies’ looking to cash in on the popularity and all of them are artificial and started at a value of $0. See http://coinmarketcap.com/

With no central bank, no transparent governing body, no company behind it, the whole thing could disappear tomorrow. Already a fake Chinese exchange that opened its doors earlier this year abruptly vanished with $4.1Million in virtually untraceable Bitcoin deposits.

There are other problems. For instance, because transactions can be made anonymously or close to it, it’s attractive for drug, gun and other smuggling payments.

Are we really talking about this?

Sure, it all sounds a little bit Kurt Vonnegut. But some fairly well informed currency experts, including a guy named Ben Bernanke, admit it is worth paying attention to as a potentially viable exchange medium. Go figure.

Size matters:

BitCoin is much too small to be part of an index portfolio and we won’t be investing in the Bitcoin ETF anytime soon, sorry Winklevossi. As a point of reference, BitCoin has a market cap of $13.8B while the world’s supply of gold is nearly 500x bigger at $6.8 trillion and silver is at $490 billion.

Bitcoin is sort of like gold, but instead of its value being based on a physical nugget of a scarce and shiny metal, it’s backed by someone picturing something shiny in their head. If some middle school kid figures out a way to forge Bitcoins, they could end up like 100 trillion dollar notes from Zimbabwe, more useful as napkins than currency.

If you’re interested, here are a couple good articles that expand on the subject.

From The Guardian. From The Economist.

Want to know more?

Give us a call at 617-217-2772 – we’d love to hear what’s on your mind

Weekly Articles by Osbon Capital Management:

"*" indicates required fields