There’s a big difference between data and insight. The financial world has been great at generating the former, but notably weak at taking the next step by creating insights. At Osbon Capital, we see that as a major shortfall and have invested heavily in reporting capabilities that let you take control of your financial information. With our industrial strength financial portal, our clients have all the information they need to understand where they are and how to reach their goals. Here’s the latest in technology.

There’s a big difference between data and insight. The financial world has been great at generating the former, but notably weak at taking the next step by creating insights. At Osbon Capital, we see that as a major shortfall and have invested heavily in reporting capabilities that let you take control of your financial information. With our industrial strength financial portal, our clients have all the information they need to understand where they are and how to reach their goals. Here’s the latest in technology.

Real insights for real people

Big data is a good start, but we believe in deep data too. To accurately calculate just your overall total rate of return, you need many thousands of data points from multiple accounts and sources. To drill deeper, you need a flexible reporting tool that reveals, organizes and clarifies.

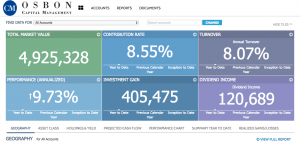

We’re excited to announce that with the latest update to the Osbon Portal, our clients can now view all of their most crucial investment information on a brand new intuitive single page dashboard.

With the portal’s smart design, you can quickly answer questions like:

- How much do I have in total?

- How have I done?

- What has the performance been in my retirement accounts compared to my trust accounts?

- What cash flow can I expect over the next year, month by month?

Even if you love excel sheets, there’s no reason to spend your valuable weekends calculating answers to these critical questions. The Osbon Portal puts all this insight at your fingertips, customized to you, at Osbon and elsewhere, available 24/7 and always on. That’s the standard that institutional investors expect and rely on. You should too.

Big data into small screens

We often talk to prospective clients who know a lot about one aspect of their finances, but can’t get a good grasp on the whole picture. We understand why! Between dividend flows, contributions, multiple trust accounts, different asset allocations, tax deferred accounts, tax exempt accounts, tax loss harvesting activity, and more… keeping track of all of your investment activity is a big messy task best left to the latest in big data engines.

If you’re already trying to do this on your own using a free service, be wary of inaccurate reporting. Our experience shows that free financial software often miscalculates, by quite a wide margin, when even a single data point is dropped. We don’t take any chances on incomplete data or botched calculations. We have a dedicated data team in North Carolina that ensures all information is reconciled daily and available 24/7 on any device anywhere. That’s our people backup.

Try it and see what you think

We’re excited to show you how it works. We have a sample account set up for those who are interested in viewing the new layout. Let us know if you’d like to take a test drive. It will really change the way you look at your finances.

Max Osbon – mosbon@osboncapital.com

Weekly Articles by Osbon Capital Management:

"*" indicates required fields