The first case of COVID was Nov 17th 2019, exactly one year ago. Moderna announced a 94.5% effective vaccine this week. Pfizer’s vaccine is 95% effective and ready for emergency use approval by the FDA in one month. We can expect more effective vaccines from Regeneron, Johnson & Johnson, Sanofi and Roche which are nearing new stock price highs this week. Small and large companies are working together and an enormous amount of money is flowing towards long-term vaccine success. As we receive good virus news, we can expect more of the depressed sectors to recover. Markets are often both forward-looking and last-minute reactionary.

Timelines

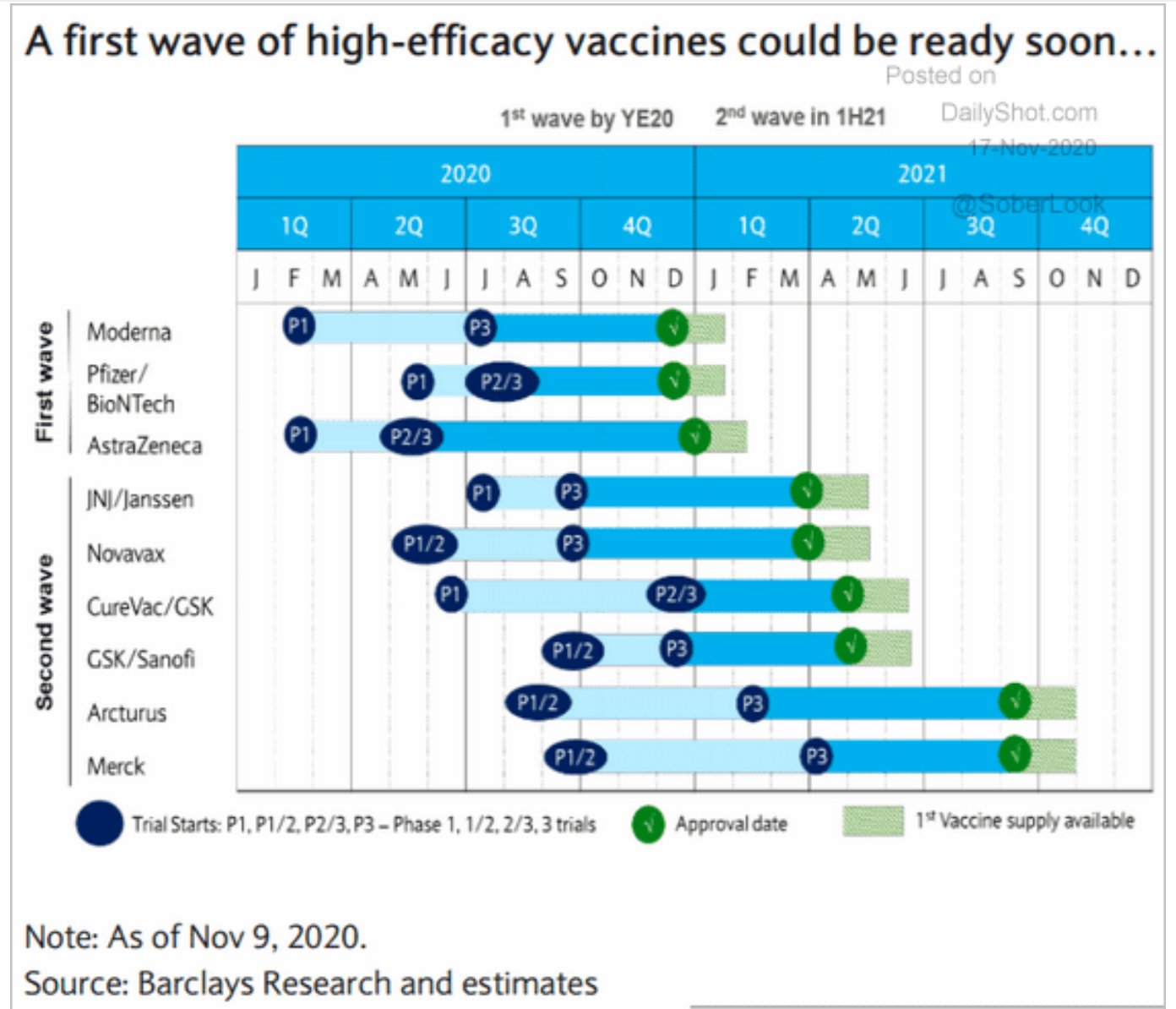

The image below shows the timeframe for various vaccines to reach the approval stage. There are nine major vaccines in the pipeline that are expected to be ready for use throughout 2021. This is a rare moment of universal global collaboration. Tens of billions have been allocated to solving this vaccine puzzle. We may have half a dozen or more effective vaccine options within one year. One year is a fairly short time period for markets.

Vaccine effect on the economy

Widespread vaccinations in the US, which will take a year, will bolster the US economy. There’s no question that the biggest weight on all of us right now is the restrictions placed on everyday normal life due to COVID. Removing the COVID factor means many businesses should be able to function normally.

US airlines employ nearly half a million people. Restaurants employ nearly 15 million people. When the most impacted sectors are able to function without anxiety or restriction, the unemployment rate should fall fairly quickly.

Vaccine effect on stock prices

Widespread vaccination in the US should help almost all of the depressed sectors in the US. The positive vaccine news from this past week has certainly helped the depressed stocks rally, cruise lines, banks, retailers, hotels, REITs, etc. Public companies have widespread access to funding sources which has prevented the stock prices of even the hardest-hit sectors from dropping to distressed levels.

Once the recovery from COVID comes, we’ll have to face some permanent changes. Business travel may never recover to its previous high. Despite any temporary vaccine rallies, we need to take a view of the broader picture. E-commerce, the evolution of the public cloud, digitized finance, AI and data toolsets, digital advertising and content delivery as well as digital health care are the major growth trends. These sectors should have strong revenue growth and great opportunities for reinvested capital for many years following the vaccine.

Vaccine effect on the Fed

The Fed has promised to keep short-term rates at zero and continue economic aid “for as long as it takes”. We have had zero rates or near-zero rates for over a decade with an accompanying explosion in government debt levels. Fortunately, low rates mean the annual cost of that debt is manageable. In a global meeting on Tuesday, Jay Powell said we are not going back to the same economy. We’re moving forward to a different economy. He says the time for fiscal discipline is not now. In other words, massive fiscal stimulus in the trillions is urgently needed.

Scenario planning for the road ahead

Diversification allows investors to be successful even when the range of possible future outcomes is wide and unpredictable. Rotation trades do happen – this is where traders swap out their winners for the next opportunity. This creates volatility for everyone, even in the highest quality assets. Investors should be aware of their overall liquidity, the quality of their equity holdings and the role of alternative assets within their portfolio. The overall stock market trend remains up due to fiscal stimulus, 0% interest rates, continuous cycles of new innovations and progress on the virus.

With the widespread availability of COVID vaccines underway the first quarter of next year could look bright. A new president will take office in the United States by then. Major decisions on government spending, borrowing and budgeting will be well underway. It pays to plan for both conservative and positive scenarios for the vaccine, interest rates, inflation as well as changes in personal circumstances.

Weekly Articles by Osbon Capital Management:

"*" indicates required fields