Week 41: Labor Challenges, Taiwan Is A Top Risk, Crypto Announcement

Briefing:

- Investors should be aware of the employment trends in leading technology companies. Fewer people building the world’s biggest companies is another key driver of the increasing wealth gap.

- Taiwan is the most important piece of the global semiconductor supply chain by a wide margin. The tense relationship between China and Taiwan is a real risk to watch.

- Osbon Capital has a crypto investment announcement.

The Great Resignation – Labor and Demographics

One major trend investors need to pay attention to today is population growth rates and labor trends. In developed countries, population growth rates have fallen below 1% and will likely turn negative from here on. JPMorgan recently published estimates that immigration will account for 85% of US population growth over the next decade. You can see the US labor pool chart here, which peaked back in 2018. For context, the US population and the global population doubled over the past 60 years. Since GDP growth is based on population growth and productivity growth, a significant engine of GDP growth will mainly be missing from now on. We have to rely more on productivity growth if we expect to grow GDP.

A friend pointed out recently that the labor participation rates are now down to 1970’s levels. The unemployment rate, which the Fed likes to quote as a primary measure, is an insufficient data point because it’s missing the bigger picture. What matters here is total jobs divided by total available workers. That employment figure (labor participation) has steadily declined since 2000, more than 20 years now. Coincidentally or not, this downward sloping trend in labor participation started when computers appeared in office settings.

So why hasn’t this reduced labor activity affected the stock market? Mostly the answer goes back to the impact of technology on jobs. Today’s leading technology companies employ far fewer people than companies of the past. NVidia, for example, employs just 19,000 people and Visa, just 20,000 people. These are the 9th and 11th largest companies in the US by market cap. The large employers are companies that traffic in physical goods like Home Depot and FedEx, which employ around 500k people each.

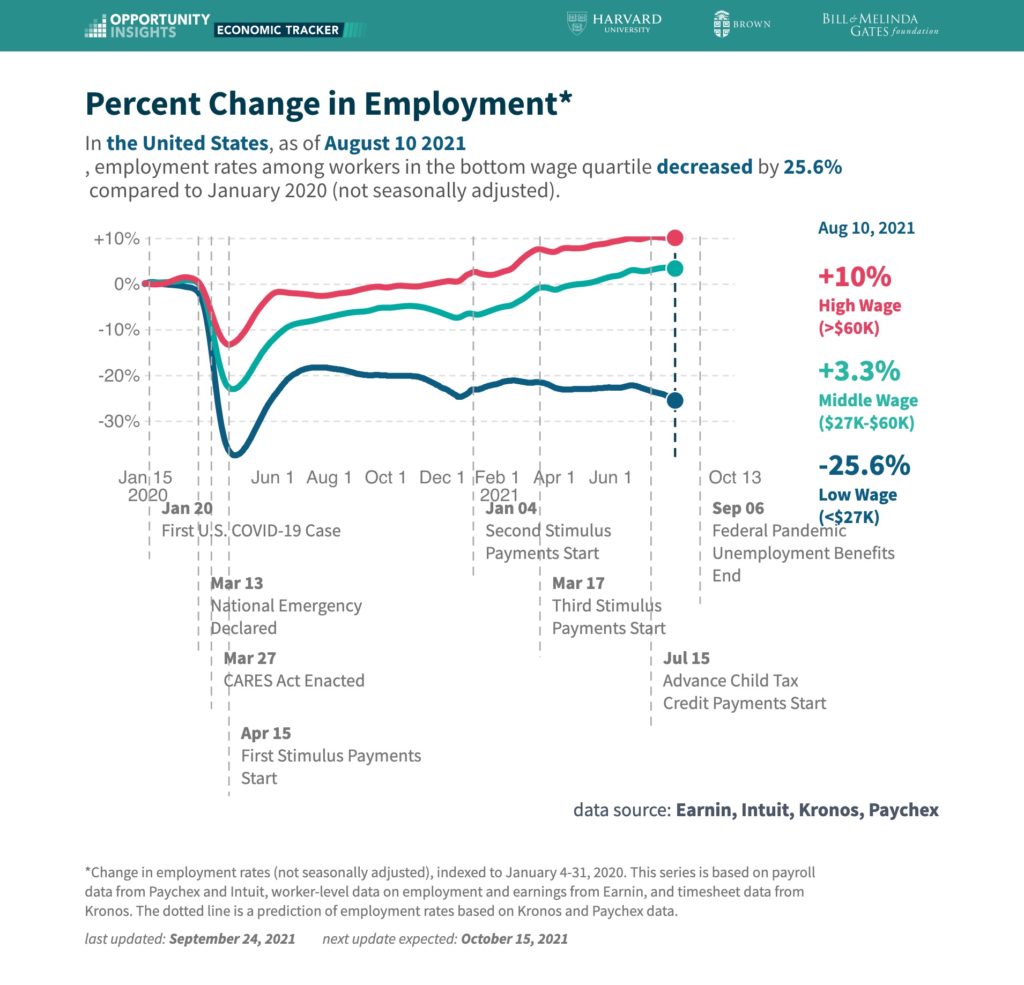

Unfortunately for our collective population, most of the losses in jobs have been in the lowest income bracket, as you can see in this chart below. In some states, the job losses for low-wage workers are -40% or worse, like CT, OR, IL and VT. You can explore the data here: https://tracktherecovery.org/.

If you follow Sam Altman, the CEO of OpenAi, then you know that he has publicly voiced his concerns many times about job losses due to AI. Many AI researchers have expressed similar concerns and have called for regulators to get ahead of this issue before it accelerates. The major takeaway here is that internet and software-based businesses can generate enormous revenues at a massive scale with relatively small teams. When you read headlines about unemployment or employment issues, that headline, more likely than not, will have little impact on the performance of the S&P 500.

Taiwan is #1 on our list of real risks

We maintain an ongoing list of existential issues that could have a significant impact on markets. The current list has thirteen items that I would share here, but I don’t want to create anxiety needlessly. If you would like to see the complete list, we would be happy to share it directly. We rank these existential risks by probability and impact. Number one on that list today is China overtaking Taiwan, which we have listed as “low probability, very high impact.” For anyone familiar with technology supply chains and the semiconductor world, Taiwan is the gateway for 63% of the global semiconductor production market and 84% of the high-end 10nm or less semiconductor market, which is crucial for products like the iPhone. Today, most companies design their chips and have them manufactured in Taiwan by TSMC via machines made by ASML.

On Saturday, October 8th, CCP leader Xi Jinping pledged to “reunify” with Taiwan. Taiwan’s Presidential Office responded by saying Taiwan is an independent country and not part of the People’s Republic of China. You can read more of Taiwan’s official statements via the link. You can imagine that Taiwan’s global semi leadership looks attractive to China. Especially after cutting the legs off of its tech leaders like Alibaba, Tencent, and others and following the Evergrande real estate debt crisis,

The real problem here is that Taiwan’s semiconductor manufacturing capabilities are extremely precise and difficult to replicate. Many have tried, and all but two companies have failed. The other is Samsung in South Korea. If Taiwan were to shut down its exports for any reason, it would leave a massive hole in the global market for semiconductors for at least a few years, if not more. Fortunately, TSMC is building a $12B facility in Arizona, and the US has pledged $50B to support domestic semiconductor manufacturing. Construction started in June 2021, but they won’t produce their top-of-the-line chips until 2024.

Crypto Investing Announcement

Please keep your eyes out for our upcoming crypto investing announcement. We will send a separate notice out shortly. Stay tuned.

Weekly Articles by Osbon Capital Management:

"*" indicates required fields