Revisiting Inflation

A typical suburban family is more sensitive to gas prices than a city resident. A contractor is more sensitive to lumber prices than a software programmer. What you consume changes your inflationary experience. If you are looking to buy a home or send kids to college you might complain about inflation more than a retiree whose house has been paid off for years, whose kids are a generation removed from college. Since inflation fears are drawing all of the attention these days, we thought it’d be a good idea to revisit the topic.

Free markets, essential products and socialized markets

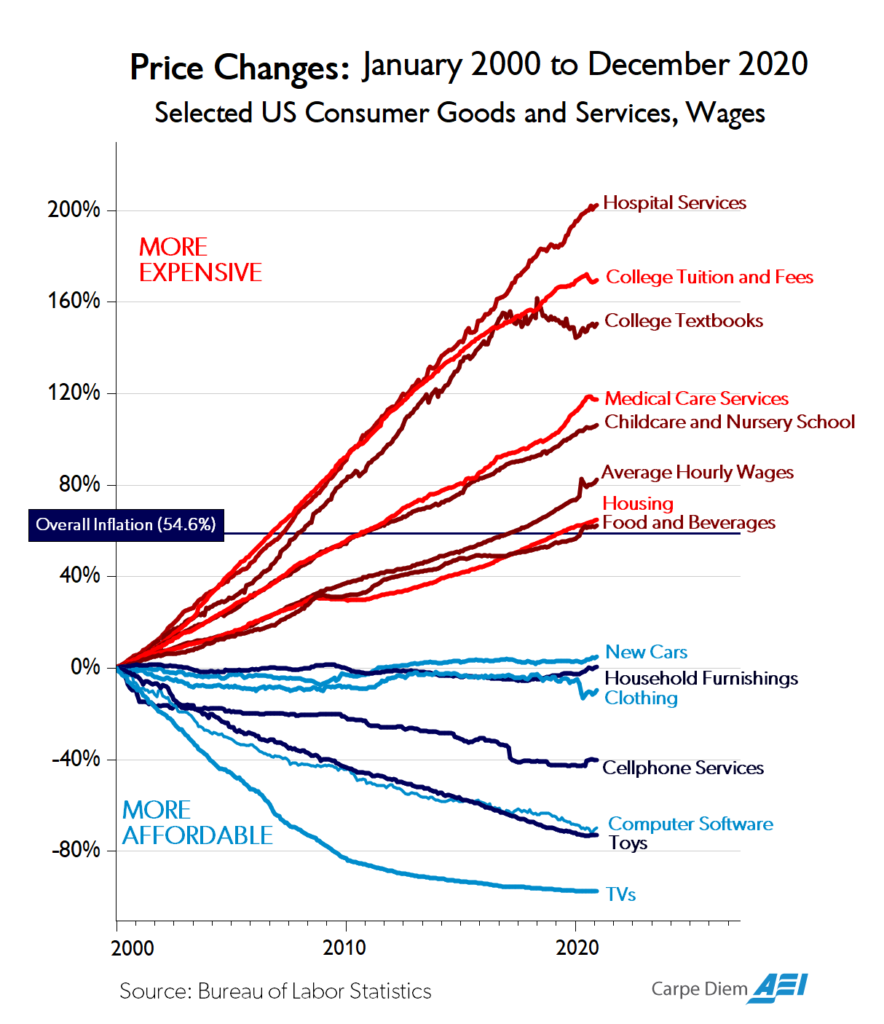

Products that operate in less regulated markets have seen substantial decreases in prices over time. Typically economists worry about deflationary effects because they could theoretically entice consumers to wait to make their purchases in order to save money. In reality, people do not wait to buy their devices which are considered essential, like most consumer electronics. Many of the TVs sold today are subsidized by ROKU in order to capture market share for their services.

The college textbook market in the above chart is a great example of a product that has not been allowed to operate as a free market. The increasing adoption of the internet and the increasing financial burden on students has pushed college textbooks down slightly as you can see in the chart above. If universities allowed open competition in the textbook market, you can imagine that students would no longer be paying $500 per book.

Free markets can result in higher prices

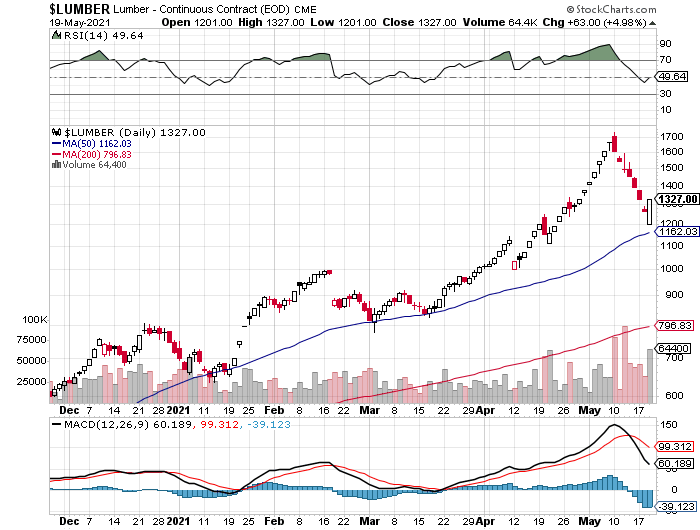

As we wrote about in our recent lumber article, the lumber market is in the middle of a supply shock (the mills are months behind schedule). Once the mills catch up with demand by adding capacity and reactivating their labor pool, lumber prices will fall. In the two weeks since we wrote that article, this pricing reset is already underway.

The government could have stepped in to set the price of lumber so that builders could continue to build houses to address our housing supply shortage. However, free markets are more efficient at fixing price issues.

Gas prices

Gas prices have increased dramatically over the past 12 months, a roughly 80% jump. That increase makes for a great headline. However, gas prices have consistently drifted lower over the past decade. Context here is important. If you drive a lot or own a trucking company, you will feel this price of gas increase more than the average consumer. Oil and gas supply chains are intensely complex and it will take time for the system to resettle.

https://www.gasbuddy.com/charts

Personalized inflation and opportunity costs

Everyone expects some form of inflation over time. This is why investing your wealth is so important, because cash frequently loses buying power every year. Over one year, the impact is small. Over 10 years, uninvested cash loses value due to loss of purchasing power and opportunity costs as asset prices rise in the housing market and the stock market.

Transitory

Today we are experiencing a massive supply chain disruption following the complete shutdown of our economy due to COVID. It’s unsurprising that supply chain disruptions would lead to higher prices. Fed Chairman Jerome Powell says that he expects the inflation to be transitory, but admits that if he is wrong that there could be real problems for the economy.

In a competitive global world with amazing access to technology, it’s unlikely that commodity prices can stay too high for too long. We recommend taking a closer look at your own expenses and how those price changes may impact your own wallet.

Weekly Articles by Osbon Capital Management:

"*" indicates required fields